A rapid assessment of a business in times of distress, for the benefit of shareholders, management, or even key customers and suppliers, can help identify potential risks and initiate appropriate countermeasures in a timely manner to preserve value for all stakeholders.

Identify and mitigate risks

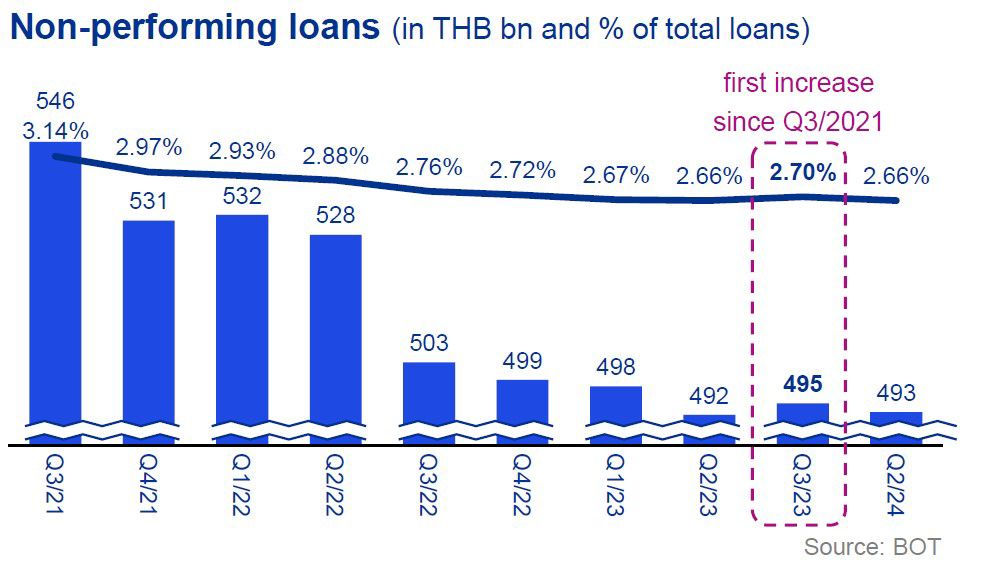

After a period of continuous recovery following the COVID-19 pandemic, Q3/2023 marked the first time since Q3/2021 that non-performing loans increased, both in absolute values and in relation to total loans.

In a tightening economic environment, it is crucial to understand business-related risks and to develop strategies to mitigate these risks.

Risks can arise in various areas and differ in nature and complexity. Therefore, it is recommended to perform a holistic analysis including the following key aspects:

Market and competition

With new trends and technologies, such as AI, evolving, disruptive products and services may put traditional products under pressure. That potentially leads to a short-, medium- or long-term decline in revenue and competitiveness.

An evaluation of market dynamics and the competitive positioning of the business can indicate a need to fine-tune the marketing strategy, product portfolio and/or operating model.

Especially in well established businesses, an outside-in perspective can bring fresh impulses.

Operations

Inefficient operations could be the reason for excess cost or unutilized capacity, leading to low profitability or negative cash flow.

Operations are key for the success of any business. However, internal processes develop and businesses change over time. This could result in operational processes and business strategies diverging, impacting effective execution of the strategy in a profitable manner.

A benchmarking of industry-specific KPIs against competitors can help identify operational inefficiencies and value creation opportunities.

Financials

Monitoring the right financial KPIs can give you early warning signs of imminent distress, such as:

- a decrease in sales

- deterioration of margins

- liquidity constraints.

Understanding the key drivers of the historical performance and development over time helps to identify challenges and opportunities for improvement.

Ultimately, the performance of a business is reflected in its financials, and it is important to target the right areas and restore healthy financial KPIs.

Tax and legal

The tax and legal framework is often neglected or is focused solely on ensuring minimum necessary compliance. However, the accuracy and effectiveness of legal agreements, corporate structure or business licenses can be key factors for success. In addition, new legislation or changes in the legal framework can have significant impacts on a business.

A thorough analysis of existing requirements and potential implications of upcoming changes can reveal tax opportunities to benefit from available reliefs and incentives, or avoid penalties, which could range from fines to revocation of operating licenses.

Rapid business assessment as a tool

A rapid business assessment can help identify potential risks before they materialize and impact performance. This type of assessment can also be used to identify value creation opportunities that can improve performance and make the business more resilient against external adverse influences.

A rapid business assessment may not only apply to a company’s operations. It can also be beneficial to understand the resilience of key stakeholders, especially in situations in which dependencies prevail. In such cases, it is essential to evaluate the business partner’s reliability to avoid a potential spillover effect on a company’s own operations.

Contact our Turnaround and Value Creation experts if you want to understand more about the benefits of a rapid business assessment or are interested in any of our service offerings.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia