Thai capital market performance

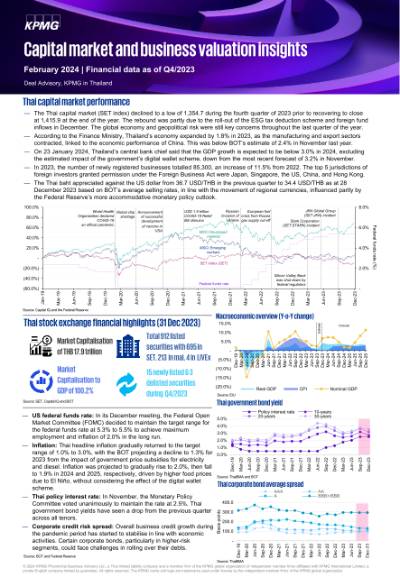

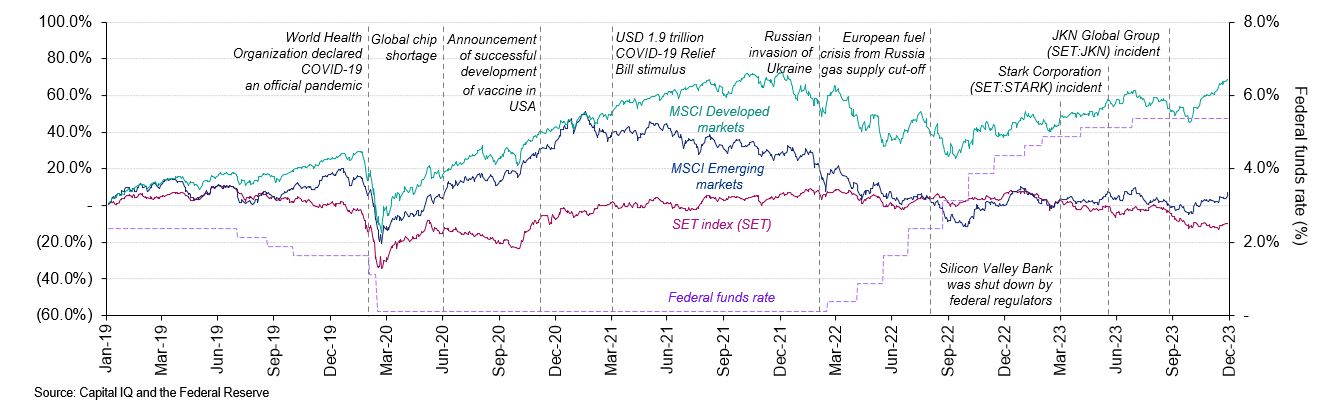

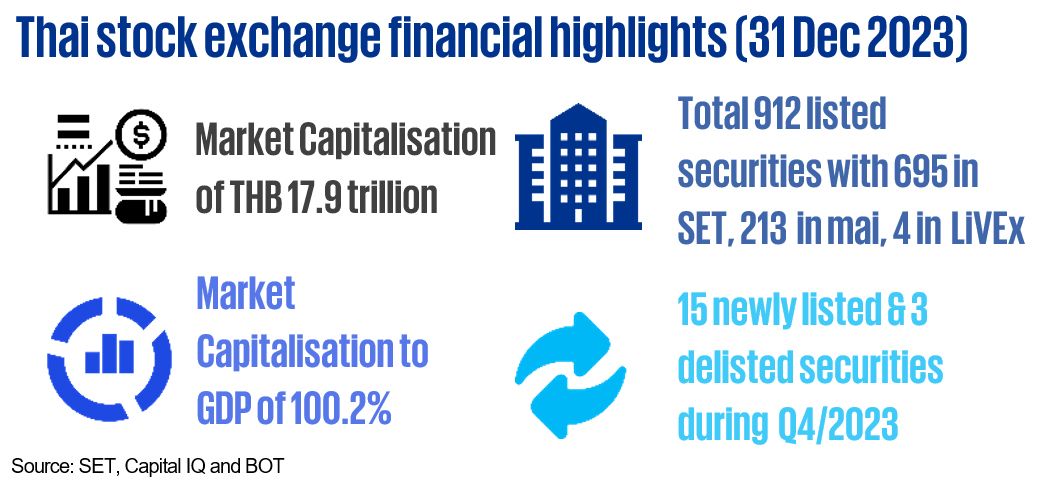

- The Thai capital market (SET index) declined to a low of 1,354.7 during the fourth quarter of 2023 prior to recovering to close at 1,415.9 at the end of the year. The rebound was partly due to the roll-out of the ESG tax deduction scheme and foreign fund inflows in December. The global economy and geopolitical risk were still key concerns throughout the last quarter of the year.

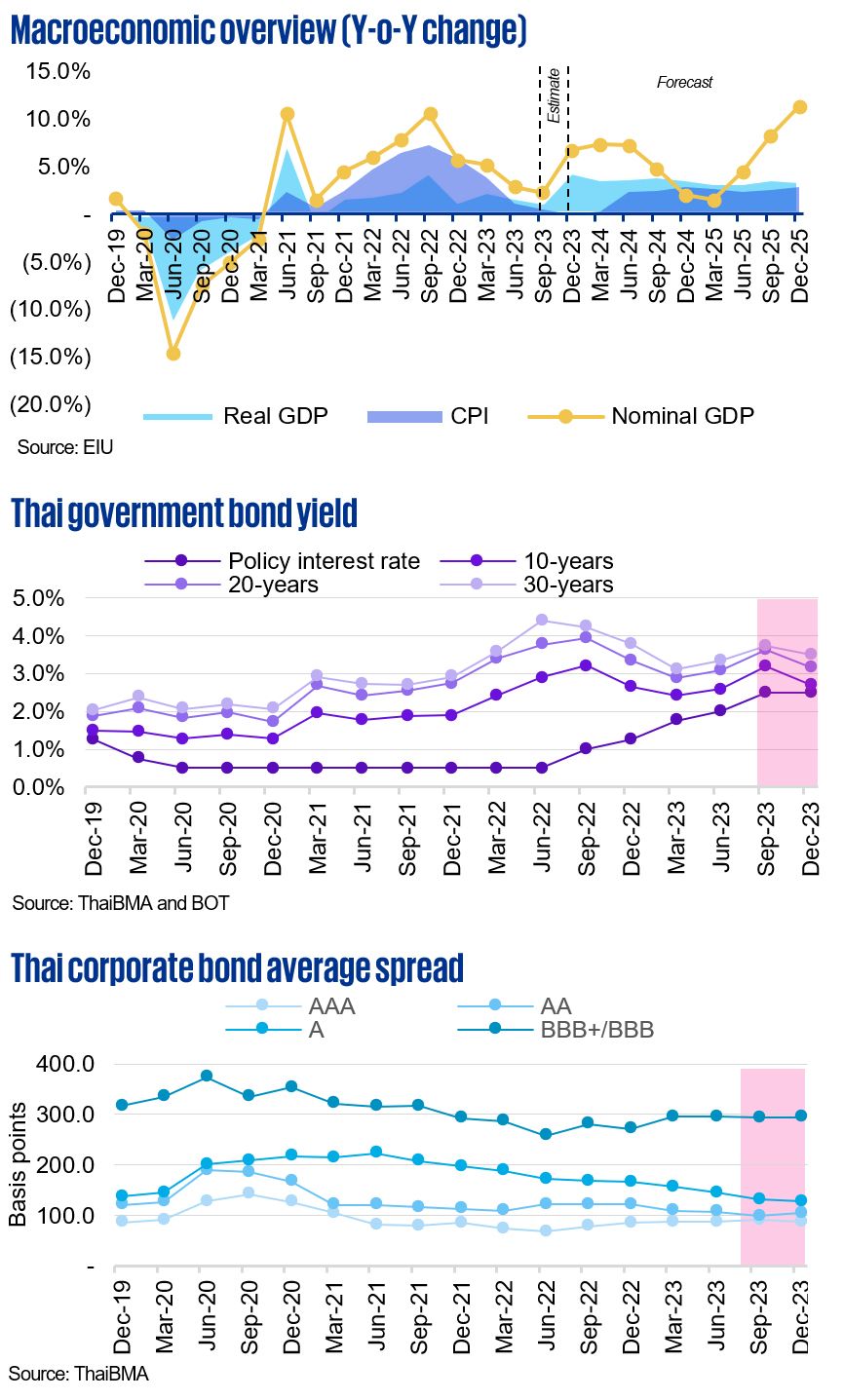

- According to the Finance Ministry, Thailand’s economy expanded by 1.8% in 2023, as the manufacturing and export sectors contracted, linked to the economic performance of China. This was below BOT’s estimate of 2.4% in November last year.

- On 23 January 2024, Thailand’s central bank chief said that the GDP growth is expected to be below 3.0% in 2024, excluding the estimated impact of the government’s digital wallet scheme, down from the most recent forecast of 3.2% in November.

- In 2023, the number of newly registered businesses totalled 85,300, an increase of 11.5% from 2022. The top 5 jurisdictions of foreign investors granted permission under the Foreign Business Act were Japan, Singapore, the US, China, and Hong Kong.

- The Thai baht appreciated against the US dollar from 36.7 USD/THB in the previous quarter to 34.4 USD/THB as at 28 December 2023 based on BOT’s average selling rates, in line with the movement of regional currencies, influenced partly by the Federal Reserve’s more accommodative monetary policy outlook.

- US federal funds rate: In its December meeting, the Federal Open Market Committee (FOMC) decided to maintain the target range for the federal funds rate at 5.3% to 5.5% to achieve maximum employment and inflation of 2.0% in the long run.

- Inflation: Thai headline inflation gradually returned to the target range of 1.0% to 3.0%, with the BOT projecting a decline to 1.3% for 2023 from the impact of government price subsidies for electricity and diesel. Inflation was projected to gradually rise to 2.0%, then fall to 1.9% in 2024 and 2025, respectively, driven by higher food prices due to El Niño, without considering the effect of the digital wallet scheme.

- Thai policy interest rate: In November, the Monetary Policy Committee voted unanimously to maintain the rate at 2.5%. Thai government bond yields have seen a drop from the previous quarter across all tenors.

- Corporate credit risk spread: Overall business credit growth during the pandemic period has started to stabilise in line with economic activities. Certain corporate bonds, particularly in higher-risk segments, could face challenges in rolling over their debts.

Source: BOT and Federal Reserve

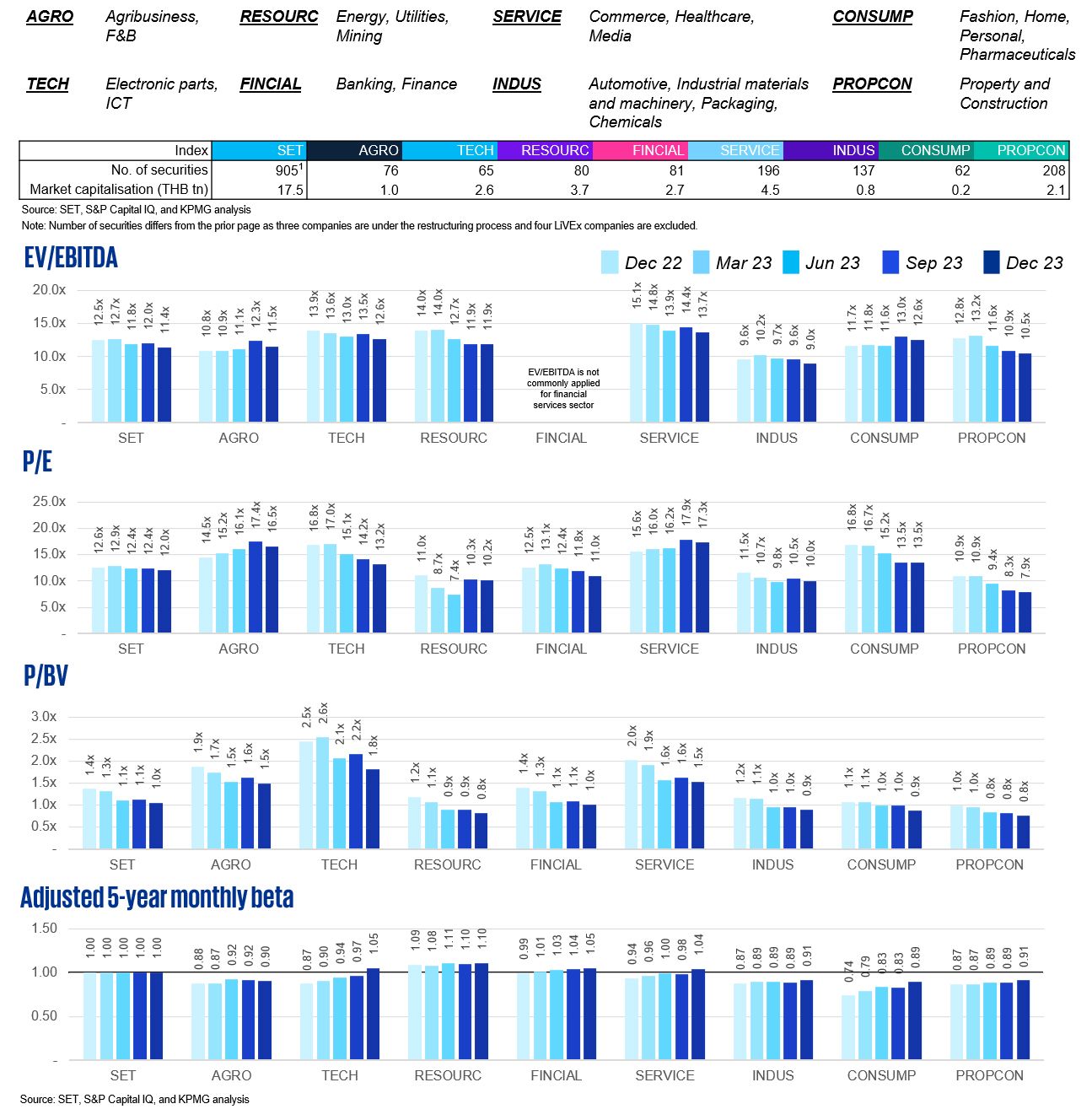

SET valuation metrics by sector (last 5 quarters)

The SET has eight key sector categories for listed entities. The three most-common valuation multiples across 5 quarters in these sectors illustrate movement due to both economic fundamentals and the impact of global events on market sentiment.

The multiples in Q4/2023 declined from the previous quarter across all sectors, in line with the movement of the SET index. PROPCON sector traded at the lowest multiple in all categories (i.e. EV/EBITDA, P/E, and P/BV).

Sector beta represents the undiversified risk of a sector. The higher the beta, the riskier it is for that specific sector. The betas in the past 5 quarters have shown a trend of convergence towards the market beta of 1.0. Betas of TECH and SERVICE moved to exceed the market beta of 1.0 in the fourth quarter of 2023.

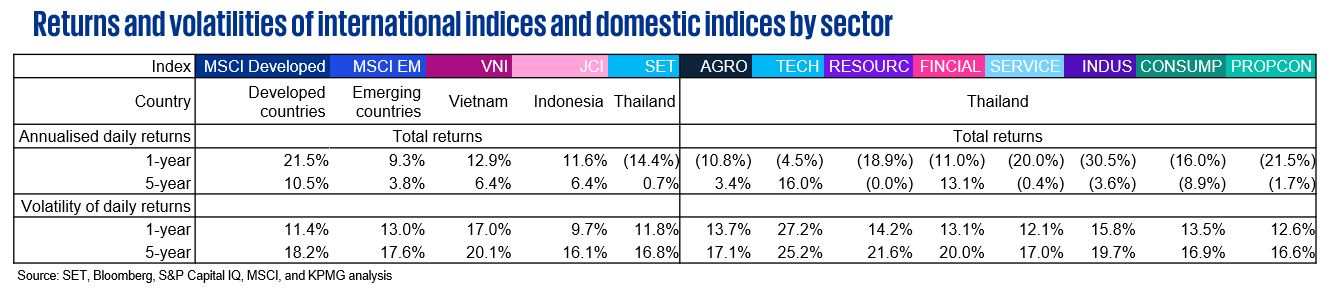

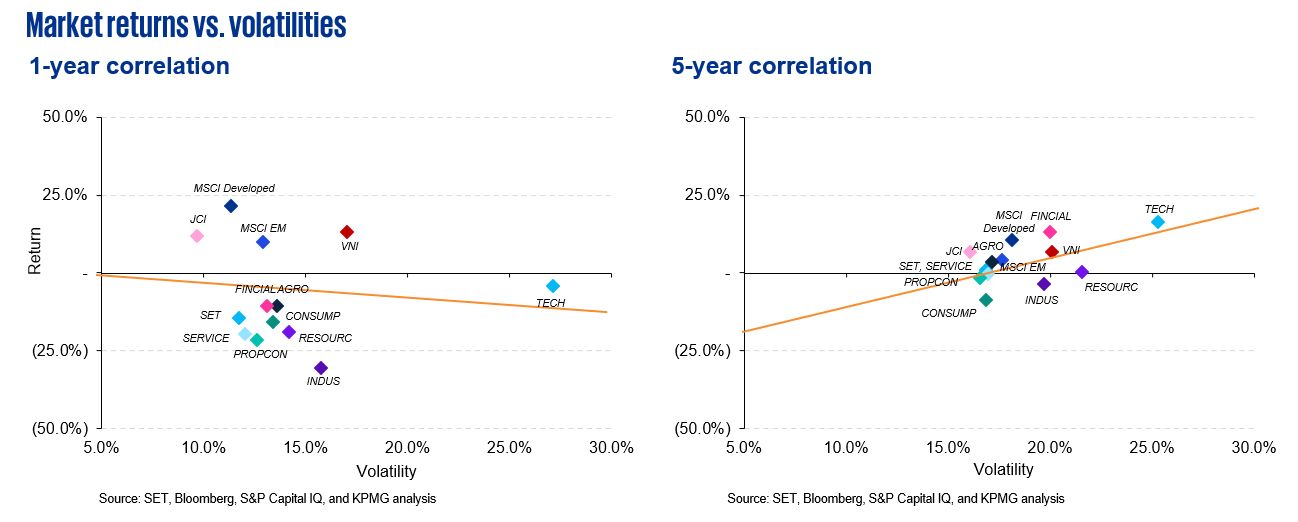

- The SET lagged behind all other illustrated indices over the 1-year observation period due to the 3.8% decline in the last quarter of 2023, while other markets went up. MSCI Developed appeared to have the best performance for both 1-year and 5-year annualised daily returns. JCI had the lowest 1-year volatility among the indices while still outperforming MSCI EM.

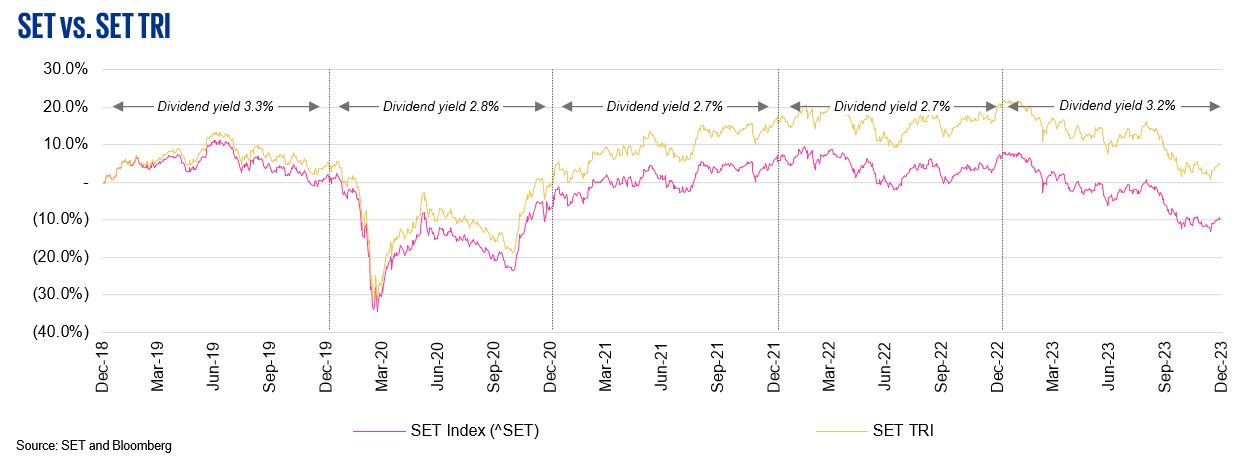

- Total return index (TRI) is an index that measures the total return from investing in securities. It comprises (1) a return arising from the change in value of the securities or “capital gain/loss”, and (2) dividends paid, assuming they are reinvested in the securities.

- Dividend yields have shown a slight declining trend owing to the expansion of value share of non-dividend-paying sectors and recent earnings trends across the traditional economy.

Data criteria

Thailand valuation multiples by sector

- The SET sector classification serves as the principal criterion for the illustrated sectors.

- The calculation of the sector valuation multiples excludes company multiples outside of the first- to third-quartile range.

- 12-month trailing multiples are derived from Q4/2022 to Q4/2023.

- Q4/2023 multiple is based on the latest available financial statement information as at Q3/2023.

- Data in historical periods may change according to Capital IQ’s retrospective adjustments.

Regression on returns and volatilities

- The total number of trading days per year is assumed to be 252 days.

- The period in the study is 1 January 2019 – 31 December 2023.

SET and SET TRI

- Annual dividend yields are based on dividend yields from Bloomberg.

KPMG Deal Advisory

"KPMG provides a full range of valuation services for all sell-side, buy-side, tax restructuring, fund raising, and joint venture transactions."

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia