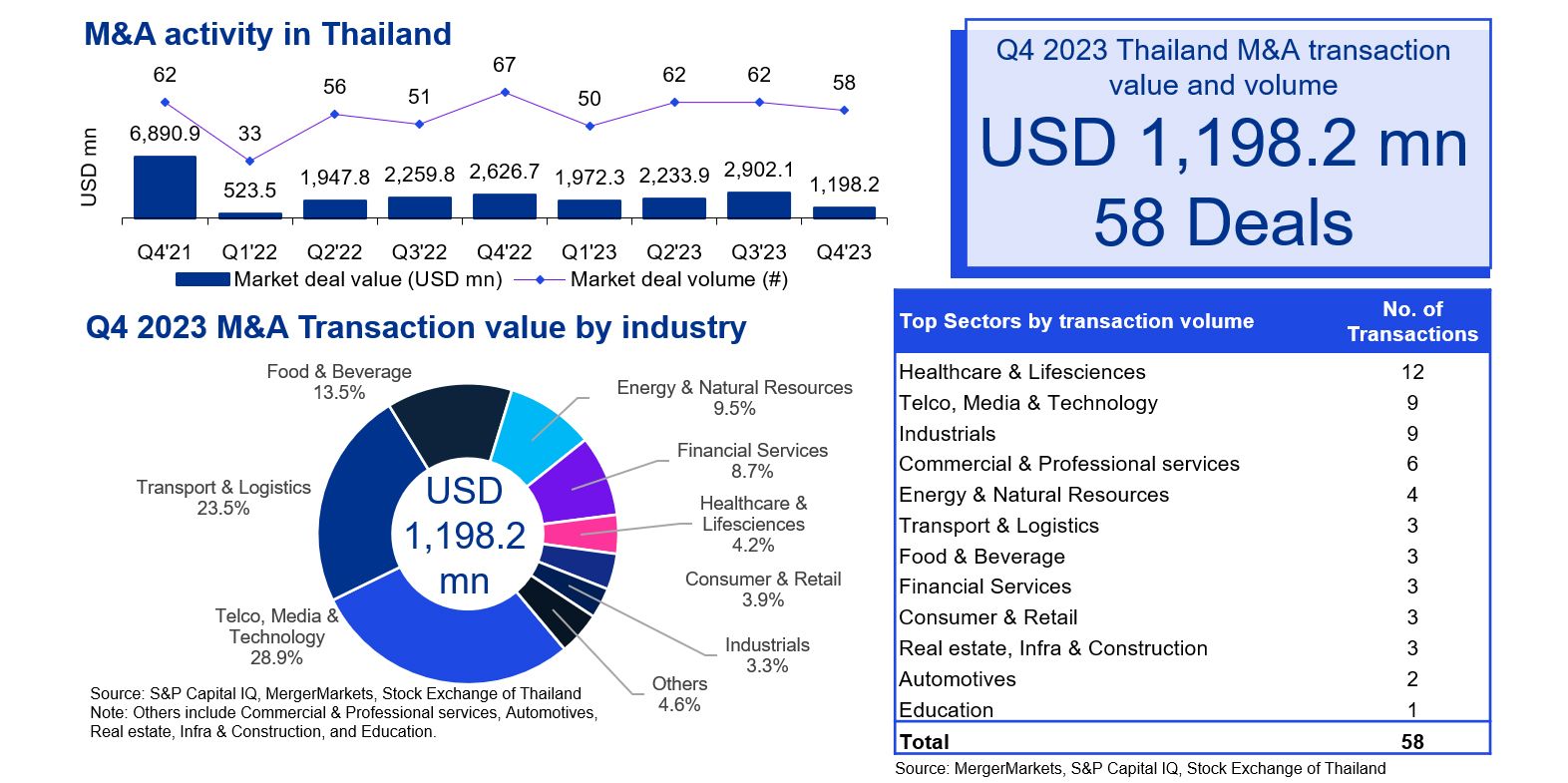

M&A activity in Q4 2023 totalled USD 1.2 billion in deal value compared with USD 2.9 billion in Q3 2023, or a total of 58 deals compared to 62, respectively. Investments in Thai companies accounted for 80% of deal value in Q4 2023, while outbound deals represented 20%. In 2024 we expect to see an interesting mix of deals as strong companies and sectors continue to be attractive and demand high valuations, but also an increase in distress which will lead to opportunities for asset managers, credit and special situations funds as well as strategic investors looking to acquire businesses at discounted valuations.

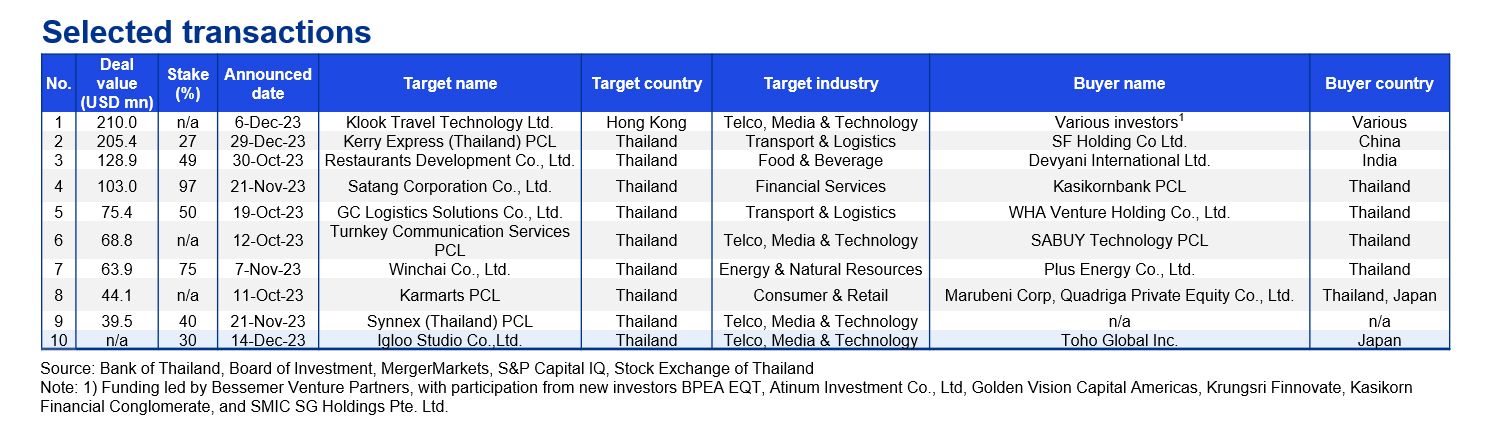

The Thai deal landscape remains robust as corporations maintain their positive outlook on growth through organic or inorganic growth strategies, and funds continue to search for well-managed, promising businesses. In Q4 2023, deals in the Transport & Logistics, Telco and Media & Technology sectors contributed 52% of the total deal value. The largest transaction was the USD 210 million fundraising for the leading travel and service booking platform operator, Klook Travel Technology Ltd., led by Bessemer Venture Partners, with participation from various investors, including Krungsri Finnovate and Kasikorn Financial Conglomerate. Other notable deals included the announced sale of a 27% stake in Kerry Express to Chinese logistics corporation SF Holding Co. Ltd., a deal valued at USD 205 million, and the announced takeover of Thai KFC operator Restaurants Development Co., Ltd. by India-based Devyani International Ltd., valued at USD 129 million. Another landmark transaction was the minority acquisition of Thai-owned Igloo Studios by Toho Global Inc., supported by KPMG’s integrated cross-border financial advisory and tax due diligence teams in both Thailand and Japan.

The World Bank decreased Thailand’s 2023 GDP forecast from 3.6% in Q3 2023 to 3.4% in Q4 2023. Multiple credit rating agencies also downgraded Thailand’s growth expectations amid heightened fiscal concerns. In response, the government has passed policies aimed to maintain growth expectations and address short-term debt issues. These include the debt relief for SMEs and private debtors, the revision of various commerce-related laws to increase efficiencies and Thailand’s competitiveness, and the proposed transportation infrastructure investments. Importantly, positive trends continue to be observed in Q4 2023 macroeconomic indicators such as a lower unemployment rate, and greater consumer confidence indices, indicative of potential domestic macroeconomic resilience.

Although the macroeconomic and monetary environment pose risks, the Thai deal environment has not been significantly affected, with corporations continuing with transactions on a delayed timeline. Overall, we expect continued M&A interest going into 2024, with slightly less deal volume and more selective deal-making expected.

Data criteria

- Value data provided in the various charts represent the aggregate value of the deals for which a value was stated. Please note that values are disclosed for approximately 50% of all deals

- Deals are included where a stake of 30% or more has been acquired in the target. If the stake acquired is less than 30% then the deal is included if the value is equal to or exceeds the equivalent of USD 100 million

- All deals included have been announced but may not necessarily have closed

- Activities excluded from the data include restructurings where ultimate shareholders’ interests are not affected

KPMG Deal Advisory

Whether you need to buy, sell, partner, fund or fix a business, our Deal Advisory team works to help you find, secure, and drive value throughout the business life cycle.

Key contacts

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia