Hedge accounting can offer a company substantial benefits by helping to reduce volatility in earnings. The application of hedge accounting, however, can often pose a challenge due to its complexity and the investment required both in terms of time and money.

A Hedge Accounting Journey

TFRS 9 became effective on 1 January 2020 which has seen major changes to the hedge accounting requirements to reflect current business environments. Although it is optional to adopt hedge accounting, TFRS 9 helps users to represent the effect of an entity’s risk management activities that use financial instruments to manage exposures that could affect the profit and loss.

Are you ready for it ?

Applying hedge accounting under TFRS 9 may require changes to risk management, treasury management, accounting processes, and data processes as well as internal controls for assessing and calculating hedge effectiveness, in addition to the extensive new requirements.

With the recent changes to TFRS 9 Financial Instruments, even more companies are likely to be eligible to apply hedge accounting under this standard. KPMG Thailand offers a reliab le solution, requiring lesstime and money to reap the benefits offered by hedge accounting.

Hedge A ccounting

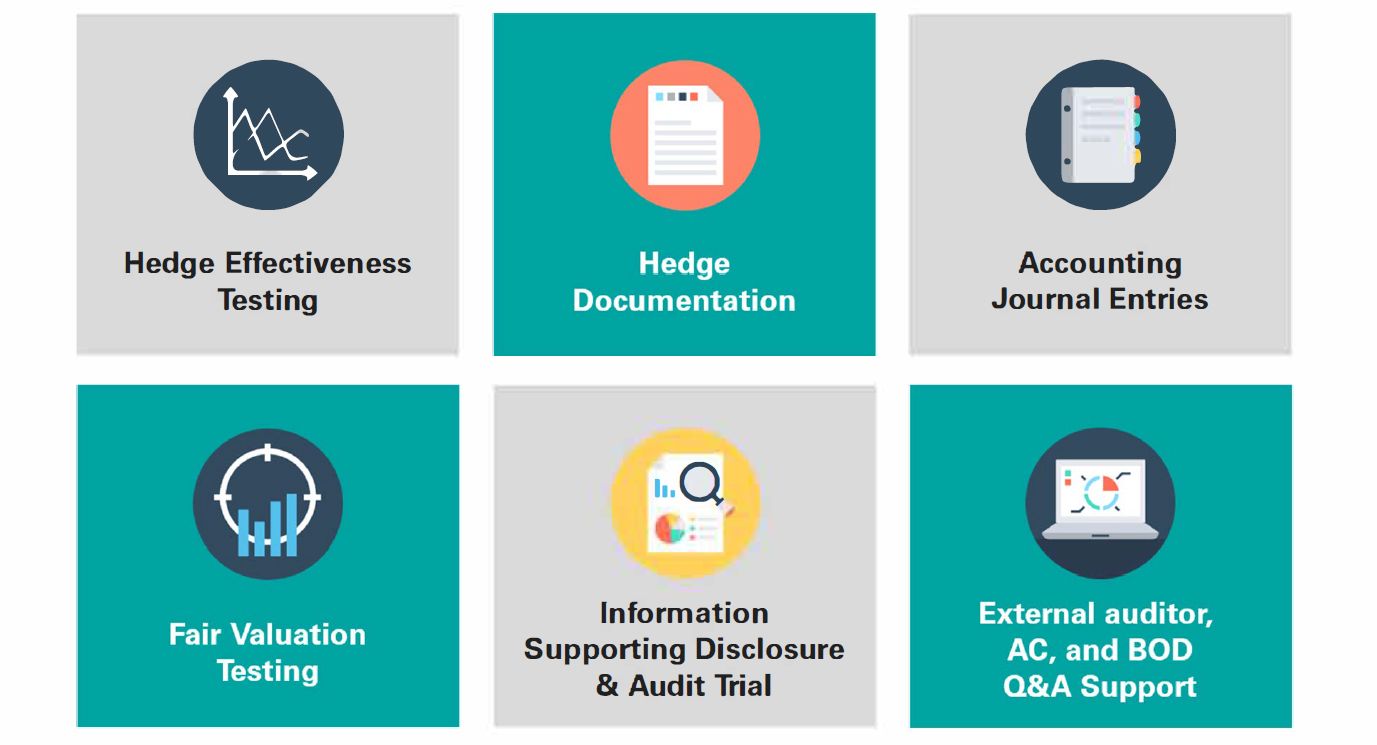

KPMG can help you with your hedge accounting needs through our KPMG's Hedge Accounting Services. We have a team of professionals who have knowledge and experience in advising numerous clients in the successful application of hedge accounting. Our services are as follows:

Many more

- ldenfity key changes that may have the most impact on existing hedges

- Assess potential new hedging strategies that align with your entity's risk policy

- Determine potential hedging cost reductions

- Better connect your internal risk management and external reporting

- Implement new hedge accounting systems

- Determine the impact of new hedging requirements on disclosures

Why assess now 7

Greater Simplification & Efficiencies

- More time to complete initial quantitative assessments of hedge effectiveness

- Opportunities to expand scope of eligible hedged item and hedging instrument

Improved Financial Reporting

- Reduce volatility in earnings and improve cash flow forecasting

- Align more with risk management strategies