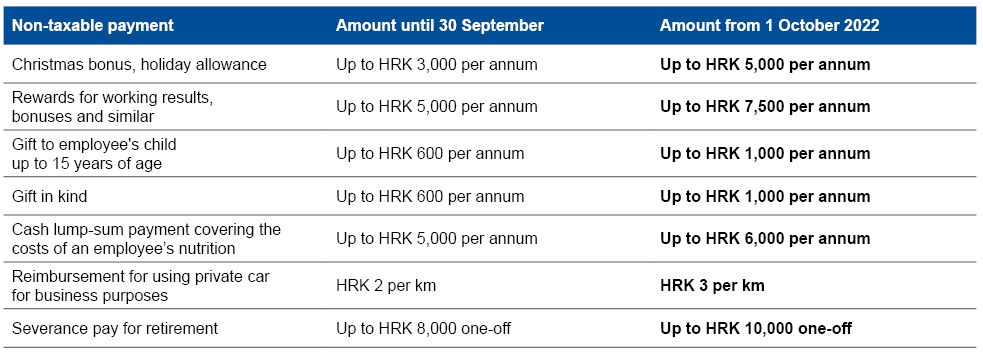

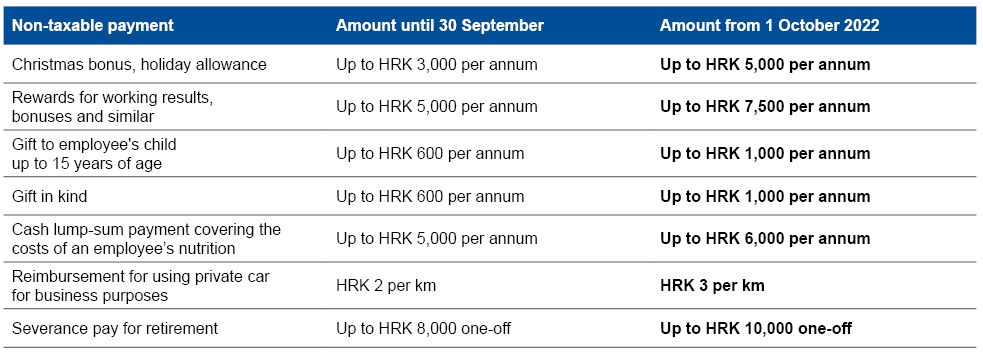

In National Gazette 112/2022 Amendments to the Personal Income Tax Regulations were published which will come into effect on 1 October 2022. With the Amendments new/increased amounts of non-taxable payments that can be made from an employer to its employees are as follows:

This means that on the annual level, the employer can make the above listed payments as non-taxable up to prescribed new amounts. If some payments from the above list were already made during 2022, the difference between the amount already paid and new non-taxable amount can be paid by the end of 2022 as non-taxable.

From 1 January 2023 it is allowed to combine the cash lump-sum payment covering the costs of an employee's nutrition and the payment of employee's nutrition costs based on supporting documents on an annual basis, but on a monthly basis one excludes the other.

Action point:

Employers should consider payments in this calendar year to utilize the increased non-taxable amounts. These payments are at the employer's discretion.