Article Posted date

21 March 2023

The budget anticipates a deficit of $5 billion for 2022-23 and projects deficits of $4 billion for 2023-24 and $3 billion for 2024-25. The government expects the budget balance to be restored for fiscal 2027-2028.

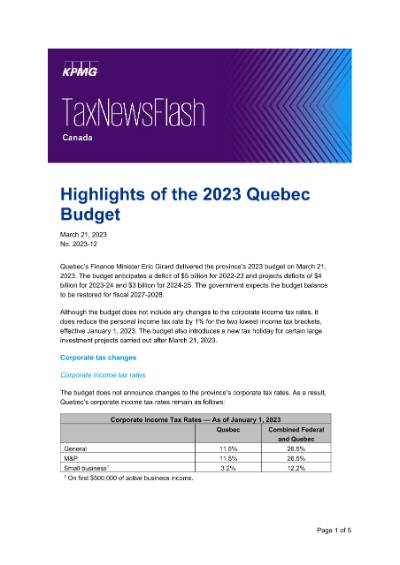

Although the budget does not include any changes to the corporate income tax rates, it does reduce the personal income tax rate by 1% for the two lowest income tax brackets, effective January 1, 2023. The budget also introduces a new tax holiday for certain large investment projects carried out after March 21, 2023.

Download this edition of the TaxNewsFlash to learn more.