Australian fintech investment trends

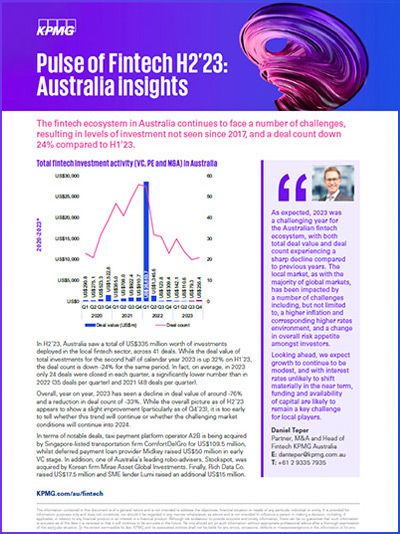

The fintech ecosystem in Australia continues to face a number of challenges, resulting in levels of investments not seen since 2017, and a deal count down 24% compared to H1’23.

In H2’23, Australia saw a total of US$335 million worth of investments deployed in the local fintech sector, across 41 deals. While the deal value of total investments for the second half of calendar year 2023 is up 32% on H1’23, the deal count is down -24% for the same period. In fact, on average, in 2023 only 24 deals were closed in each quarter, a figure significantly lower number than in 2022 (35 deals per quarter) and 2021 (48 deals per quarter).

Overall, year-on-year, 2023 has seen a decline in deal value of around -76% and a reduction in deal count of -33%. While the overall picture as of H2’23 appears to show a slight improvement (particularly as of Q4’23), it is too early to tell whether this trend will continue or whether the challenging market conditions will continue into 2024.

KPMG Australia's Head of Fintech, Dan Teper said: "As expected, 2023 was a challenging year for the Australian fintech ecosystem, with both total deal value and deal count experiencing a sharp decline compared to previous years. The local market, as with the majority of global markets, has been impacted by a number of challenges including, but not limited to, a higher inflation and corresponding higher rates environment, and a change in overall risk appetite amongst investors."

Four key Australian fintech trends

The four key trends for Australian fintechs are:

- Profitability continues to trump growth.

- Payments sector to remain hot.

- Enhanced focus on AI applications.

- M&A and investor sentiment expected to improve as market conditions recover.

Global fintech investment update

2023 was a difficult year for the fintech market globally, with both total fintech investment (US$113.7 billion) and the number of fintech deals (4,547) experiencing their weakest results since 2017.

Given the level of uncertainty in the market in 2023, it was no surprise to see fintech investment back off substantially from the levels seen over the last 2 years.

While H1’24 is likely to start off in a very subdued fashion, any downward movement in interest rates could spur some renewal of deals activity.

The exit environment will also be critical to watch as the extended lack of exits has made investors globally particularly hesitant to make large deals.

|

Explore KPMG's full global report for:

|

Contact KPMG Australia's fintech specialists

Get in touch with a KPMG fintech specialist, and sign up for Australian fintech insights delivered to your inbox.