KPMG's Advisory professionals assist clients through a range of services relating to Strategy & Operations Consulting, Management Consulting, Risk Consulting and Deal Advisory. Together, these services help address a client's strategic needs in terms of growth (creating value), performance (enhancing value), and governance (managing value).

Our Services

Change things - engage your customers and accelerate your business.

People and Change Consulting | Cybersecurity | Procurement Consulting

KPMG’s Risk Consulting services group is built on addressing clients’ urgent strategic and operational challenges in today’s environment. The practice focuses on key risk areas relating to accounting and reporting, finance and treasury, and regulatory compliance and controls.

Basel IV | Actuarial Services | Credit Risk Management | AML and Sanctions Regulatory Compliance | Accounting Advisory Services

KPMG’s integrated team of specialists works at deal speed to help you find, secure and drive value throughout the acquisition lifecycle.

Buying a business | Selling a business | Fixing a business | Funding a business | Partnering

Insights

-

Recalibration of Shocks for IRRBB

-

Digital Transformation in Insurance: A People-centric Approach

-

Artificial intelligence and its expanding role across the biopharma landscape

-

Virtual Assets 2023 Review and 2024 Outlook

-

24th Annual Global Automotive Executive Survey

-

Enhancement to the Code of Banking Practice

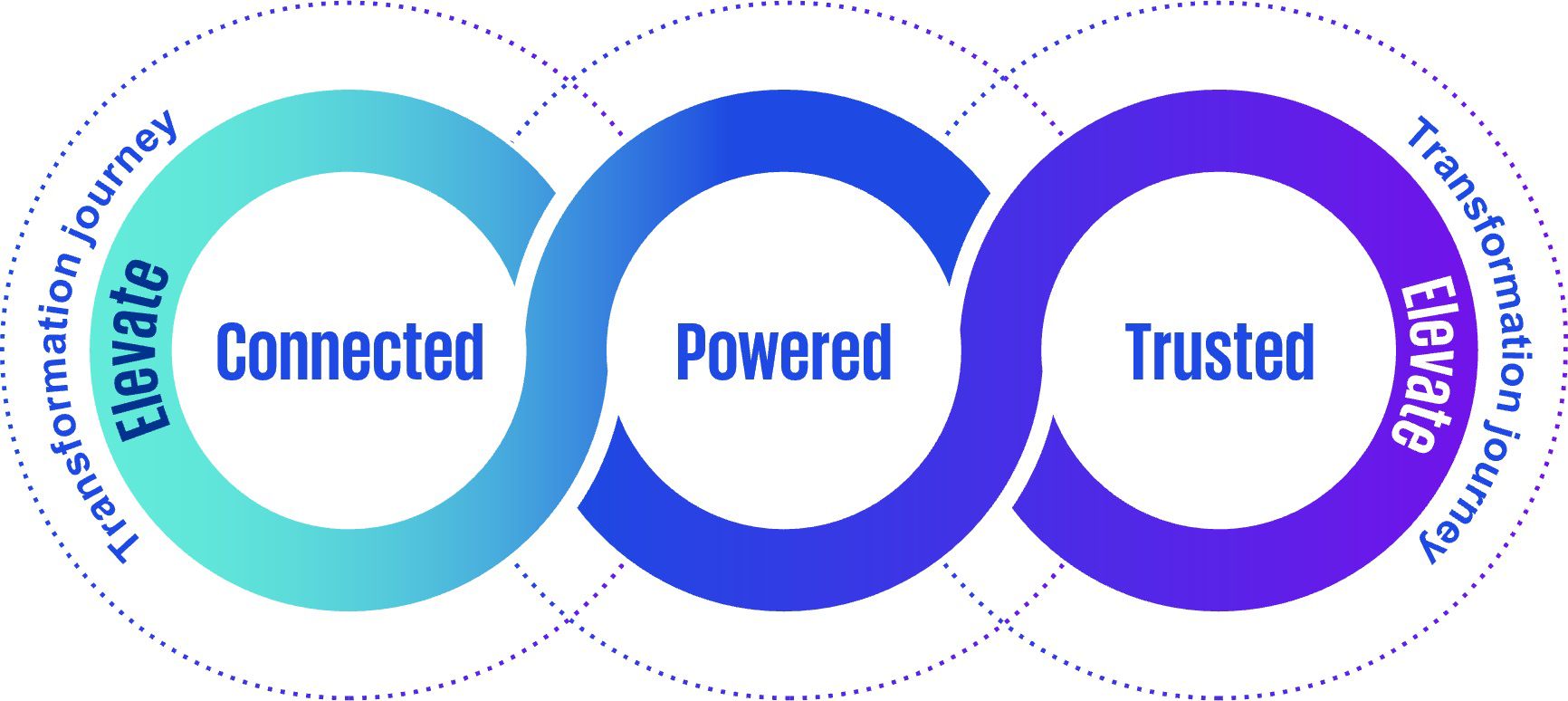

Connected. Powered. Trusted. and Elevate

Connected. Powered. Trusted. and Elevate is the KPMG suite of business transformation solutions that help clients get to a more productive and sustainable future. The solutions are designed to address different client challenges and different parts of a business or an operating model. Each one contains rich insights and is underpinned by our leading transformation methodology.